Guest post by: Ian Mucignat CFA. Ian is a professional mortgage broker with TMG The Mortgage Group who helps individuals get the best mortgage products at the best price.

Bridge loans are a confusing concept for people. Don’t feel bad, I know people that work at mortgage lenders who find them confusing!

Bridging is often required when the sale of your current home occurs after the purchase date of your new home. Appropriately, you are “bridging the gap” for the funds needed to close the new home. In simpler terms, the lender is actually lending you the down payment and closing costs for your new home while you wait for the equity from the sale of your current home.

When is it useful?

After selling your current home and purchasing a new home, sometimes it’s hard to line up the closing dates on each perfectly. Bridge financing allows you to accept sale offers on your existing home for dates that don’t match the closing date on your new home.

Bridging can also be a good idea if you want to do some renovations on the new home, such as paint or install new flooring. During this time, you can still live in your current home while the work is being done so you won’t have to live through the mess.

Let’s look at an example

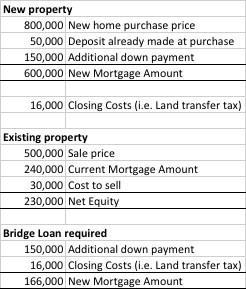

You purchase a home on March 1 with a closing date of June 1 for $800,000. You’ve listed your home and it’s sold for $500,000 with a closing date of July 1. Your current mortgage is $300,000 and you intend to put down 20% or $200,000 of equity on the new home so that you’ll have a $600,000 mortgage ($800K – $200K). You’ve already put down $50,000 so you need another $150,000. In addition, you need to cover the closing costs such as Land Transfer Tax at the lawyer’s office so you need an additional $16,000 or so. They will lend you this too, assuming of course you have the equity available from the sale of your existing home.

So, in this example, the lender will provide you a bridge loan of $166,000 on June 1. You will repay it on July 1 when you receive $230,000 from the sale of your home and be left with $64,000 in your bank account.

What does it cost?

It depends on the lender. There is usually and administration cost up to $500 for set up and the lender will charge interest on it during the bridge period. The rates vary from about Prime + 2% to Prime +4%. The rate may seem high but it only applies for a short time. So, in our example, borrowing for one month might cost about $900, which is relatively small compared to the greater purpose it achieves.

How long can I bridge for?

Again, it depends on the lender’s policy. For most lenders it’s typically a maximum of 30-60 days. Other lender/banks may extend to 120 days or even longer.

How do I get approved for a bridge loan?

If you are approved for the new mortgage, then you likely meet all the requirements for a bridge loan. Furthermore, the bridge requirement doesn’t limit your ability to be approved for the new mortgage. Most banks and lenders offer bridge loan solutions.

What is required?

The requirements vary from lender to lender but in all cases they want the unconditional purchase agreement on the new home and the unconditional sale agreement on the existing home. This assures the lender will get the bridge loan repaid when the existing home sells. The lender may also ask for your current mortgage statement to prove the equity and the MLS listings to give more assurance one the home valuations.

The bottom line

Bridge loans can be an essential strategy when making a housing transition. Educate yourself on how one can be used to help you accomplish your home ownership goals.

This information is of a general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed and Queensbury Strategies Inc. assumes no responsibility or liability.