As I write, in 2018, the Tax-Free Savings Account (TFSA) program is ten years old. And what a fine ten-year-old it is! Who doesn’t love being able to set money aside tax-free, for a lifetime? Not to mention, any amount contributed, as well as any income earned in the account (e.g. investment income and capital gains), is typically tax-free even when it is withdrawn. Take that, RRSP!

Of course there’s a catch, and it’s in the limit on how much you can contribute. The thing to keep in mind – and I suspect you know this already – is to maximize the amount you put in your TFSA every year. It’s a no-brainer.

How much can I contribute?

Oh the joys of online data! The CRA tracks all of your TFSA contributions, updating the figure every January – even if you have more than one TFSA, with more than one institution (you can have several TFSAs, but the number you have does not affect the amount you are allowed to contribute each year). However, you’ll need a CRA account to access this data. I highly recommend going through the process of acquiring one (check out this cheery little 3-minute video to learn more, and/or start here), particularly for those of you who don’t excel at paperwork.

You can also find your TFSA contribution room in your latest tax return.

From your CRA login – what next?

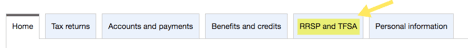

If you’re having trouble finding your contribution room with your CRA login, here’s a step by step instructions (with screenshots!) to guide you:

- Go to the CRA My Account login page.

- Log in, either through your sign-in partner (typically your bank) or your chosen user id/ password.

- Click on the RRSP and TFSA tab

- Click Tax-Free Savings Account (TFSA) which is likely the last of the links shown, below your RRSP deduction limit and Home Buyer’s Plan.

- Now, click on “Contribution Room” which should be the first link you’ll see.

- You’re now at the disclaimer – you may even want to read it. Once you have (or haven’t!) click the blue Next button underneath.

- Now you’ll see your contribution room for this year, which will probably look like this screenshot. If you’ve read the disclaimer, you’ll already know that any contributions or withdrawals you’ve made this year will not be included – as mentioned above, the number is updated once annually, at the beginning of each calendar year.

- Make sure you use that contribution room, this year and ongoing – make it an investment priority!

More about TFSAs

For those of you with adult children, now’s the time to get them started on a TFSA, if they haven’t already. In summary

As of 2015, only 10% of Canadians had maxed out their contributions to the TFSA! For anyone trying to save for anything – house, retirement, 3-masted yacht – the TFSA should be your first port of call. Plus, as I’ve mentioned before, no government program is ever guaranteed to return year after year – get it while it’s hot!

To find out more about TFSAs, click here for the CRA webpage.

Make sure you use that contribution room, this year and ongoing – make it an investment priority!

This information is of a general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed and Queensbury Strategies Inc. assumes no responsibility or liability.