You may have read that if you’re getting a tax refund, you’re not tax planning properly. After all, why would you want CRA to use your money for the year only to give it back when you file your tax return?

Getting a large refund simply means that insufficient tax was withheld on each paycheque from your salary or pension income.

Tax withholding isn’t perfect

Your employer estimates your tax rate based on your compensation adjusted for group retirement savings into a company RRSP or pension plan. They don’t know whether you’re making an RRSP contribution (reduces your tax rate) or whether you have taxable income from other sources (increases your tax rate). You can ask them to withhold more tax if you are confident in your estimates of RRSP contributions and/or other income sources.

Simply tell your employer that you would like additional tax withheld. They will give you a form to sign.

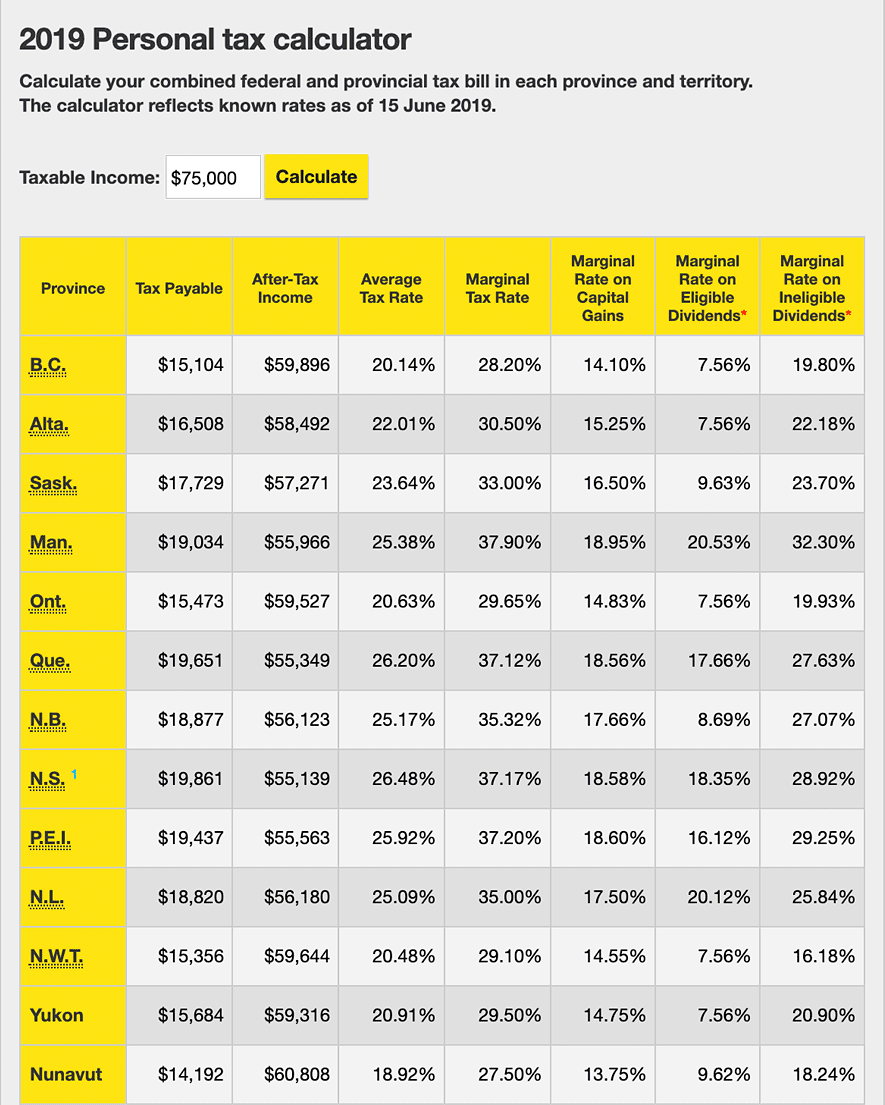

Estimating your tax rate isn’t difficult. Here are the steps to help you.

- If you have a financial planner or accountant, ask them to make a withholding tax recommendation.

- In the absence of an advisor:

a. Add up all income before tax

b. Subtract your planned RRSP contributions and any other sizeable tax credits you qualify for

c. Enter the total in this calculator (remember to use the most current year version. It gets updated annually).

d. Find your Province

e. The Average Tax Rate is the figure you can use as a guide for choosing an appropriate withholding tax rate.

f. Marginal tax rate is the rate that applies to the “next dollar” of earnings beyond your income assumption

g. The type of income matters as you can see from the different tax rates

Source: https://www.ey.com/ca/en/services/tax/tax-calculators-2019-personal-tax

Source: https://www.ey.com/ca/en/services/tax/tax-calculators-2019-personal-tax

Which way builds more wealth?

The argument that avoiding a tax return is better is technically correct. But think about it this way: Would you be more likely to do something meaningful with the tax refund if you received a bit on each paycheque, or if you receive it in a lump sum when you file your taxes?

The increase in your pay each period may not be that much money. And it may get lost in your everyday spending.

If instead, you get a sizeable refund at the end of the year you can do something more wealth-building or life-affirming with that larger amount of money. You may be motivated to reinvest it in your retirement savings, pay down your debt, or take that special vacation you’ve been dreaming about for a long time.

Don’t worry if you get a big tax refund at the end of the year. You’re not doing it wrong. The key is to take that refund and do something with it that builds more wealth, adds to the quality of your life, or a bit of both.

- Rona is registered through Caring-for-Clients for financial planning services. Financial Planning is not the business of or under the supervision of Queensbury Strategies Inc. and Queensbury will not be liable or responsible for such activities.

-

This information is of a general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed and Queensbury Strategies Inc. assumes no responsibility or liability.