There was a lot I was taught in school that I don’t find helpful in everyday life. Calculus comes to mind (I’m no engineer), and that time I almost threw up dissecting a frog was more traumatizing than instructive.

But, if there is one concept that I learned in university that stuck, and that I have referred to frequently over my career and in life in general, it’s the law of supply and demand.

The economic law of supply and demand is one of the most important and practical lessons in life.

Here’s a quick refresher: The law of supply and demand is a theory that explains the interaction between the sellers of a resource and the buyers for that resource. The theory defines what effect the relationship between the availability of a particular product and the desire for that product has on its price.

We are influenced by the law of supply and demand on a daily basis. You may believe that the law doesn’t influence your behavior, but if you are a human being, it plays you like a violin.

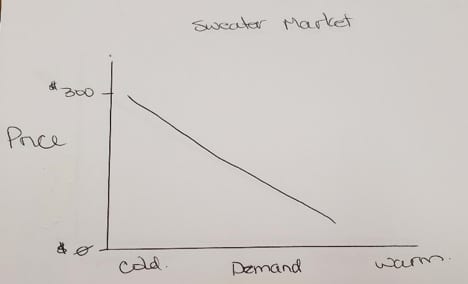

The law of supply and demand for sweaters

Let’s start with an example. It assumes that you live in a climate that experiences cold winters. Our friends in Vancouver will have to use their imagination a little bit.

Below is a supply and demand chart for high quality, warm winter sweaters.

The sweater I want is $300 when I see it first in December. It’s black, beautiful, warm, and more than I want to spend. The weather has been temperate, so I hope for a price drop before it gets really cold in January.

January arrives, and it is unseasonably mild. I return to the store and see that the sweater is now 25% off. Hmmm, that’s $225. Still expensive, and it isn’t really that cold out. I hold out in the hopes for a lower price.

February arrives and I’ve survived without needing another sweater. But the weather has turned colder, and when I return to the store the sweater is gone. Ugh. That sweater really was worth $225 to someone. I acknowledge that it was great quality and would have lasted me for years and years. I’m mad at myself. I should have recognized the value and bought it. I go home annoyed and with a feeling of regret.

The temperature continues to drop and winter extends well into March. I need a sweater.

I return to the store, and notice the sweater I wanted but unfortunately, it’s grey. But it’s 50% off! I guess grey isn’t as popular as black. I snap it up.

I only wear it once before Spring arrives. I tuck it away in storage until next winter.

Winter arrives with a vengeance. Colder and harsher than the last 10 winters. I’m mad at myself again because I didn’t buy two sweaters at 50% off. Granted, it was a brown sweater, and brown isn’t my favourite colour, but comfort is paramount to fashion when it’s -30 degrees out.

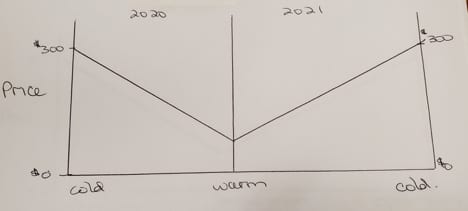

Most supply/demand charts only show half of the picture. Here is the full chart for sweaters.

I’m doubly mad at myself because even if the following winter was abnormally warm, the following one would likely be back to average. The extra sweater would be waiting in my drawer until it was needed. It was short-sighted of me to only buy one.

You probably know where I’m going next with this, but please play along all the same.

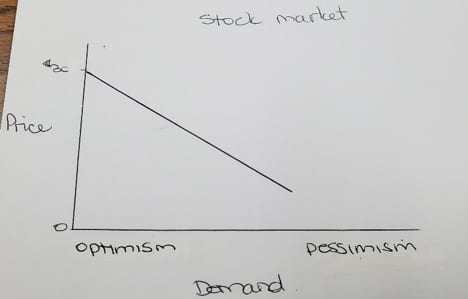

The law of supply and demand for equity funds and ETFs

Assume that you need a return on your investments to fund your current or future lifestyle. Some people are so wealthy that they don’t need a return on their money, but that’s not the vast majority of investors.

Below is a theoretical supply and demand chart for high quality, equity mutual funds and ETFs.

It’s January, and David* needs to make his annual RRSP contribution. The last 10 years of returns have been excellent and he wants to add to his equity fund to avoid missing out on the momentum in the markets that are hitting new highs daily. He uses his annual work bonus to make his contribution but it doesn’t get paid until February and is annoyed that he has to wait. The unit price of the fund he wants to buy is $30.

February arrives along with his bonus. The economic weather has changed dramatically. The momentum shifted from optimistic to pessimistic. Unit prices fell quickly and dramatically by 15% to $25.50 per unit. David needs to make his RRSP contribution for the tax savings, but hates the idea of seeing the unit value fall below $25.50 if he buys now. He thinks it will fall further. So, he leaves the money in cash until he can buy at an even lower price.

David was right, over the next few months, markets weaken further. The price of the fund is now $15 per unit, a full 50% less than in January. His existing portfolio has shrunk in size and retirement is feeling farther away than ever.

He goes for a walk to feel better and buys some sweaters at 50% off. He puts them in a drawer for the next really cold winter. Unfortunately, he didn’t buy his favourite equity fund at the same time. Instead, he keeps his money in cash in the event that this time is different and winter never returns, I mean, the stock market never recovers.

If everyone is selling, who is buying?

Like sweaters, there is a certain price at which savvy investors recognize a bargain. Even if it means the investment will sit untouched in a drawer/portfolio, for years until it delivers value. Savvy investors understand that they have invested in a collection of great companies that may be profit constrained for a while, but will make money hand over fist again. The savvy investor muses about this while paying their internet bill, buying their groceries, and doing their banking. Business doesn’t grind to a permanent stop.

Unfortunately, for David, he isn’t that patient, and fears that things are different this time. He’d rather wait until the market recovers before investing his hard-earned cash.

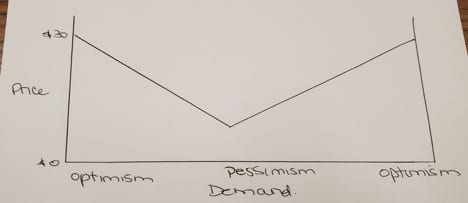

Most supply/demand charts only show half of the picture. Here is the full chart for equity mutual funds and ETFs.

The stock market eventually recovers.

David is mad at himself because economic recessions and equity bear markets have always been followed by an economic expansion and equity bull market. It was short-sighted of him not to invest when his equity fund was “on sale”.

He’s warm though.

- Rona is registered through Caring-for-Clients for financial planning services. Financial Planning is not the business of or under the supervision of Queensbury Strategies Inc. and Queensbury will not be liable or responsible for such activities.

-

This information is of a general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed and Queensbury Strategies Inc. assumes no responsibility or liability.