Morgan Ulmer CFP®

Certified Financial Planner® professional

Morgan joined the team in February, 2019 with 8 years of financial planning and financial literacy training under her belt. She is as comfortable working on complex financial planning engagements as she is helping young adults understand budgeting and debt management.

If you are under 40, do you need to pay for a customized financial plan? People in this life stage juggle many priorities, often with limited dollars. Buy a house now, later or never? Have one spouse stay home with kids? Go back to school? Pay down debt or invest?

A comprehensive financial plan can help sort out your priorities and inform your choices.

However, we would be naive to think that every Canadian under 40 is going to pursue a written, personalized financial plan. So, plan or no, here are 5 steps you can take toward building a bright financial future.

- Sign up for your employer’s matched savings plan

- Have enough life and disability insurance

- Pay off revolving debt (credit cards and lines of credit) within 3 years

- Know your savings rate

- Avoid lifestyle inflation

Sign up for your employer’s matched savings plan

These programs are more important than having a budget, more important than saving for a house, even more important than paying down credit card debt. They are your best and easiest path to creating wealth. Sadly, people miss out on thousands of dollars of free money by not participating. Where else can you earn a 50 – 100% rate of return on your money? If your employer has a matched savings program that you are not a part of yet, stop reading and run to your HR department to sign up.

Have enough life and disability insurance

If you had a machine in your basement that printed $75,000 a year in money, you would insure it. Guess what? You are that machine. If your ability to generate income disappeared, how would that affect your family? If you suffered a permanent disability, how would you support yourself? Your financial planner can help you calculate how much insurance you need. You can also find DIY life insurance calculators and disability insurance calculators online.

Pay off revolving debt within 3 years

Is your revolving debt (credit cards and lines of credit) scheduled to be paid off within three years? Use this debt calculator if you’re not sure. After three years, debt fatigue has a higher chance of setting in and thwarting your debt repayment plans.

If you’re having trouble paying down your debt, try the debt snowball or debt avalanche method. You might even want to consider converting your revolving debt to a traditional instalment loan. Beware – consolidating debt and then racking up more credit card debt is a risk. Put the credit cards away until you’ve broken the debt cycle.

Know your savings rate

Take a moment to calculate your savings rate. In other words, what percent of your gross earnings are you saving for your future? Rules of thumb:

- Ten percent of gross pay if you start in your 20’s.

- Fifteen percent if you start in your 30’s.

Is your savings rate lower than that? Is it 0%? Don’t despair! Here are a couple of suggestions:

- Sign now, save later – If you have a hard time getting started on saving, try a “sign now, save later” approach. This means completing the online enrolment and/or paperwork now for a savings plan that will begin in the future.For example, suppose you know you’ll be receiving a $200 per month raise in three months. Log in to your online banking now to set up a monthly savings plan that starts later. Most financial institutions will let you delay your start date for a year or more! When the time comes, the hard work is already done and you won’t miss the raise on which you were never reliant.

- If you are currently hyper-focused on paying down debt, that’s great. Keep doing that until you’re done. Then turn around and apply that same rigour to savings.

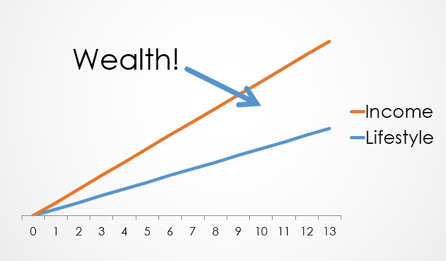

Avoid lifestyle inflation

One of your most powerful levers in building wealth is to avoid lifestyle inflation. Is your income set to go up 5%? Endeavor to have your lifestyle go up by less. This is how true wealth is created.

We love point #12 of this article about keeping lifestyle inflation in check: Having a repertoire of “free and low-cost things you deeply enjoy”. Grab a pen, paper and anyone you spend a lot of time with for a brainstorming session.

We also enjoy the point in this article that sometimes lifestyle inflation is okay. Namely:

- Your needs change

- You spend on a long term goal that you’ve purposely been saving for

- You are investing in yourself

Applying any or all of these five steps to your finances gives you a great start, no matter what age you are. A financial planner can customize a plan that suits your goals and circumstances.

This information is of a general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed and Queensbury Strategies Inc. assumes no responsibility or liability.