New – Bare trusts are exempt from trust reporting requirements for 2023

Starting in the 2023 tax year, new trust reporting requirements came into effect that require many Canadians to start filing a trust tax return (specifically, a T3 and Schedule 15 forms). As part of these new rules, many financial structures that were previously exempt from filing must now file. These new reporting requirements include bare trusts and trusts with no income or dispositions.

Though you might assume that these new requirements won’t apply to you, unfortunately, the impacts of these changes are far reaching. This is because not all trusts are formal trusts with a trust deed. Whether or not something qualifies as a trust is often a legal determination. Even if you haven’t formally created a trust, your financial affairs may still qualify as a trust for tax reporting purposes.

Overall, the rules are complex. To better understand the intricacies, here are two excellent tax articles by BDO and Ernst & Young.

For the average person who doesn’t have a formal trust or a corporation, the following scenarios are the most likely to qualify as a trust for tax reporting purposes:

- Couples who have a joint non-registered investment account where one owner is responsible for the tax on the account (it was their money invested), and the spouse is a co-owner for estate planning purposes only.

- Parents who have a joint bank account with a minor child and if the combined bank balances exceeded $50K during the year (2023).

- Parents or grandparents who have an (informal) in trust account for a minor child, such as a brokerage or investment account.

- Elderly parents whose adult children are joint on bank accounts or investment accounts; this includes situations where the child is acting as their parent’s power of attorney for property.

- A parent or a child who is on the title of real estate that they don’t beneficially own; this includes a parent who’s named on their child’s principal residence (perhaps to co-sign their mortgage), or an adult child who is named on their parent’s home for estate planning reasons.

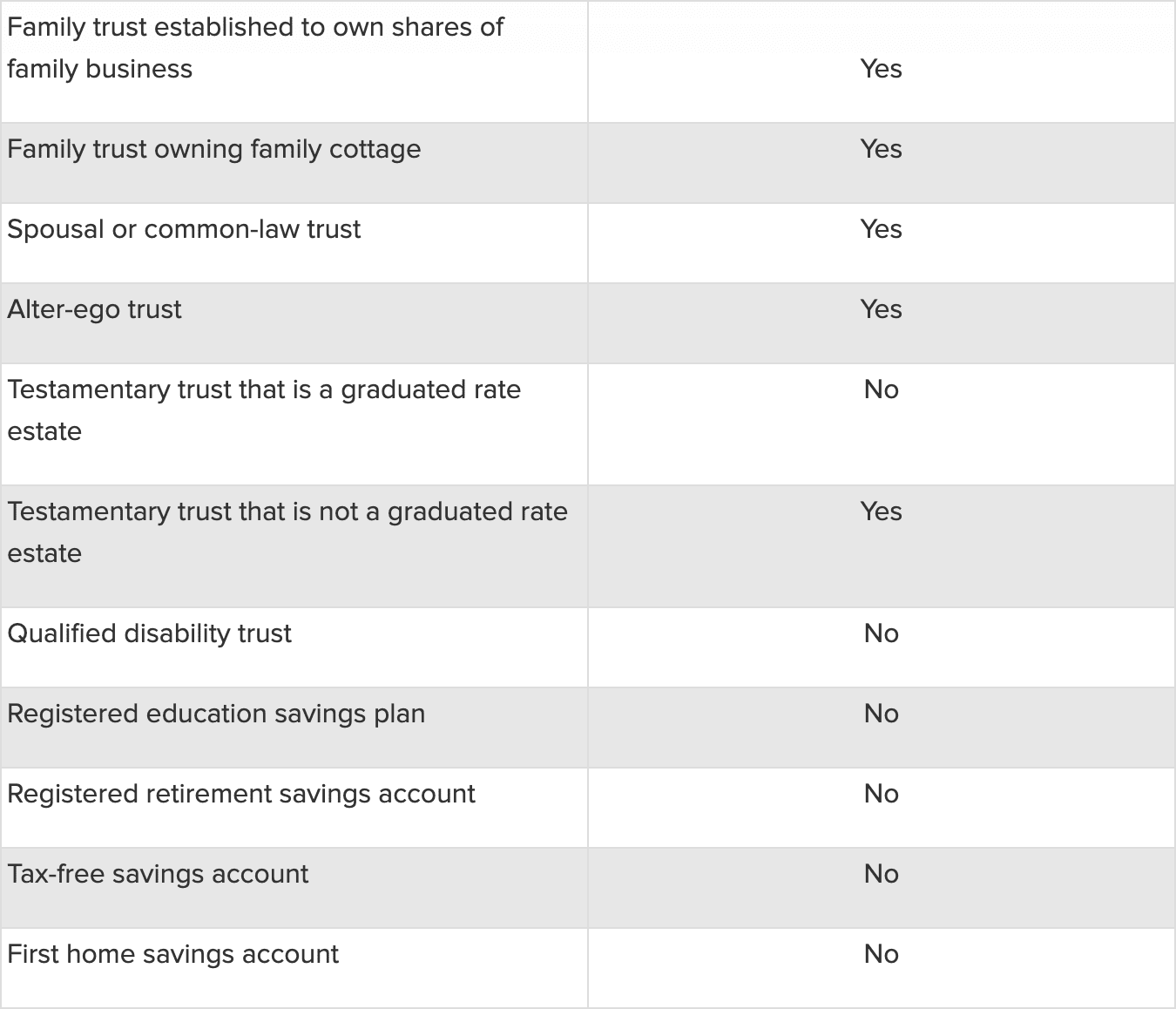

For formal trusts, the below chart from BDO’s article provides an excellent summary of whether or not a trust falls under the new reporting requirements:

What should you do if you think these rules might apply to you?

Don’t ignore the risk.

The penalty for non-compliance is significant. It’s calculated as the greater of $2,500 or 5% of the highest fair market value of the trust’s assets during the year. If you have real estate worth $1.5 million that qualifies as a trust for tax reporting purposes, this equates to a $75,000 penalty. Note that for bare trusts only, this penalty is being waived for the 2023 tax year. However, CRA has warned that this penalty may still be applied. This would be of particular concern if there is a deliberate decision to ignore the bare trust filing.

Let your accountant know immediately.

They are best positioned to help you assess if this new reporting requirement applies to you. Don’t count on them to proactively bring these new rules up; they may not know to ask you the question. Because this new reporting requirement applies to trusts with no historical income, in many cases, your accountant isn’t aware of the existence of assets or ownership structures that now need to be reported.

The first year of trust filing and may require you to dig up a lot of new information. For instance, Schedule 15 requires extensive disclosure of information relating to the trust’s trustees, settlors, beneficiaries, and any controlling persons. Your accountant will need as much runway as possible; the tax deadline for most trusts is Tuesday April 2, 2024 (versus April 30th for individuals).

These new rules leave several questions unanswered that CRA will hopefully clarify over the coming months. Please be patient with your accountant (and yourself) as you work through this process. It should become much easier after the first filing is done.

This information is of a general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed and Queensbury Strategies Inc. assumes no responsibility or liability.